All readers would be very familiar with the term Mutual Funds, and most of us have also invested our savings in various Mutual Fund Schemes. During interaction with many of my friends I got a feeling that most of them had a very vague understanding of how Mutual Funds work. Understanding Mutual Funds is important to most of us, as this is the best way to optimize safety and return of investment. All savings and deposit scheme options tend to be return/tax inefficient beyond a point. This is where Mutual Fund Schemes come into picture, and it becomes important to understand the comparison between Mutual Funds and Deposits / Savings.

Broad Structure of Mutual Funds

Mutual Funds are set up under strict regulation and supervision of The Securities and Exchanges Board of India (SEBI). The Sponsor is the entity who creates a Mutual Fund. The MF is organized as a Trust. The Trustees appointed by the Sponsor oversee that it functions towards achieving the objectives of its beneficiaries, ie the investors. The sponsor also creates an Asset management Company (AMC) which carries out the operations and investments. As the name suggests it is a fund made up of varying subscriptions from a large number of investors. Mutual Funds are supposed to work for mutual benefit of all investors.

Problems of a Retail Investor

A retail investor has several disadvantages while investing in Financial Markets on his own. He lacks the technical expertise, and the time required to carry out the required research for timely decisions. He does not have a large capital base required to achieve the necessary diversification to minimize risk. The minimum subscription to several investment options is much beyond his capability. And, as an individual investor he cannot influence corporate decision making . At times he may also not be able to redeem his funds if there is no buyer available.

How MFs Benefit the Retail Investor

Investing in Mutual Funds solves the problems listed above and also offers several other benefits. It gives the benefit of scale and expertise to the investor. Even at small levels of investment, one gets the benefits available to a large-scale investor. It provides collective voice to all investors and helps influence corporate decision making. It gives benefit of diversification even for small amounts of investments. Individuals can reduce transaction costs due to scale of operations and bargaining power of the fund house. The investor can choose from a diverse spectrum of schemes suiting his investment objectives. He can rest assured that under the strict supervision of SEBI, his/her interests shall be safeguarded within the scope of subscribed risk.

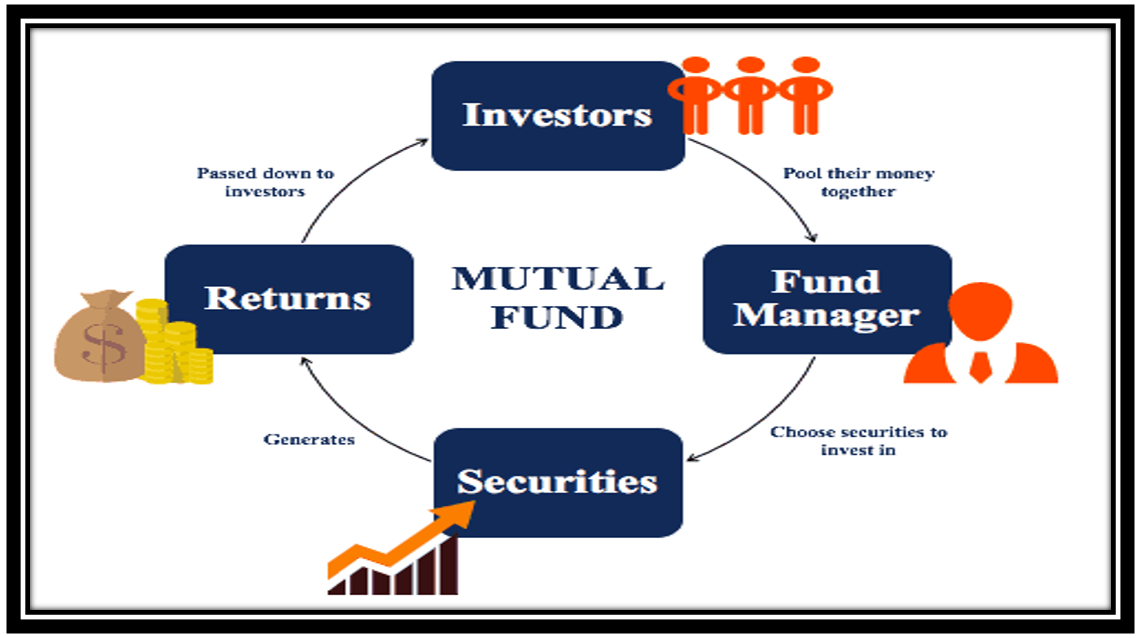

What does the MF do with Investors’ Money ?

Mutual Funds invest the pooled money from investors in the assets as specified in the Mutual Fund Scheme Offer Document. The underlying asset could be Debt instruments like Government Bonds, Corporate Bonds, Commercial Papers or Certificates of Deposits etc. It could be equity shares or commodities like Gold etc. The value of assets purchased may increase or decrease over time. Also, there will be some income associated with assets like interest from bonds, or dividends from equity shares, or capital gains by selling assets at prices higher than the purchase price. They add this income to the fund and increase the value of the investor’s investment.

The Mutual Fund Scheme allots MF units to each investor corresponding to the investment. The value of each unit on any given day is measured as NAV (Net Asset Value). The NAV changes with change in the value of the underlying asset factoring the expenses towards running the scheme. All MF Schemes calculate NAV on a daily basis.

How to Invest ?

With the dynamic evolution of financial technical infrastructure, investment in MFs has become very simple today. One can either do the investments himself by using online facilities, or take help of any registered broker/distributor. Investors can make investments either in bulk, or at regular intervals through the Systematic Investment Plan (SIP). At times beginners confuse SIP to be an investment, which is a very wrong understanding. One should understand that it is only a particular mode of investment. The investor needs to study the MF Scheme to be sure of the underlying asset and investment objectives.

How do Investors get returns ?

The MF schemes also share their income as dividends which they pay periodically to investors who choose to receive dividends by exercising the Dividend option. The dividend amount is now taxable in the hands of the receiver at rate applicable to him/her. The fund value falls when the scheme pays dividends, and that reflects in the NAV by a corresponding reduction in its value. The investor can also choose not to receive Dividend, but to accumulate the earnings by choosing the Growth Option wherein the NAV keeps increasing. In the case of both the dividend or the Growth option, when the investor wants to redeem funds, the difference in purchase price and the sale price, is income in the form of Capital Gains. The investor should be aware of the tax treatment of “Capital Gains“.

Categories of MFs

There are many ways to categorize MFs. For an initial investor it is important to understand the categorization from the perspective of risk, return and taxation. The basic categorization from this angle is Debt and Equity, which are distinct classes.

Debt Mutual Funds will invest your money only in Debt instruments like money market, government/corporate bonds, commercial papers and certificates of deposits etc. The primary mode of income is the coupon rate ie the interest earned on these instruments. The risk is of default in either the interest payment or the principle payment, or both.

Debt

The taxation is more efficient as compared to savings/fixed deposits due to two reasons. Firstly, the income qualifies as Long-Term Capital Gains (LTCG) after three years. Secondly, the investor will have to pay tax on income on redemption which the he can deliberately defer to qualify as LTCG. The tax is also only on that proportion of income which has been redeemed, and not on the entire accrued income.

For eg if ₹ 1 lakh grows to ₹ 1.07 lakh and the investor redeems ₹ 30,000/- , then the taxable component of income would be only 30% of ₹ 7,000/- ie ₹ 2100. One can relate this to the disadvantage in case of savings/deposits wherein the income is accrued at the due date irrespective of the need, and the recipient has to pay tax accordingly. Comparing it to the previous eg, If an FD of ₹ 1 lakh matures to ₹ 1.07 lakh, than the entire ₹ 7,000/- would be taxed on the day of maturity.

Equity

The equity MFs will invest the money to purchase shares of listed firms and the income will be in the form of dividend and price appreciation as per increase in net worth of the concerned company. Equity bears higher risk and also a potential for higher returns which are highly volatile and is variable. The taxation is also different and gains within a yr qualify for tax at 15% as Short Term Capital Gains. The gains after one year attract tax at 10% as LTCG. One can see that the lower tax rates compensate the higher risk in equity investment to some extent.

Overall Debt MFs are good for short term investment primarily aiming at safety of capital along with predictable and inflation beating returns, whereas Equity MFs are good for long term investment and growth of capital.

Types of MFs

The various categories of MFs as laid down by SEBI are five and within each category there are further different types of MFs. Every Investor should become familiar with the “Different Types of Equity Oriented Mutual Funds”. There are also a lot of hybrid categories/schemes which give the combined benefit of both debt and equity by investing the money in debt as well as equity in specified proportions. We will discuss in greater detail the various types of Debt Mutual Funds in subsequent articles.

Summary

The aim of this article was to draw attention of readers to the following key points:-

(a) Debt Mutual Funds are comparable to, and better than Savings/Deposits from the return/taxation perspective.

(b) Equity MFs offer greater potential for growth over long term, albeit at higher risk.

(c) SEBI safeguards the investors’ interest and regulates the MFs well.

(d) Mutual Funds differ greatly on account of the underlying asset and the consequent risk/return/taxation, and therefore the importance of carefully reviewing the particular scheme before investing.

(e) Different categories and types of Mutual Funds serve different needs which are individual specific, and therefore one should not copy/ape someone else’s portfolio.