Tax is an evil which we all wish we could do away with. But the universal fact is that the more you earn, greater is the pain of income tax that you have to bear. The motivation to save tax is highest for those in the higher tax slabs. There is therefore no need to amplify the desire/need to have proper tax planning by investing in tax efficient instruments.

Income Categories

The definition of income is very broad based and you can find it at Sec 2 of the IT Act. We can broadly categorize all forms/sources of income under the following heads: –

(a) Income from Salary. This includes salary and pensions. Details pertaining to income from salary are provided by the employer in Form 16.

(b) Income from house Property. This pertains to rental income derived from house property.

(c) Income from Business/Profession. Income from business or profession (self- employed) would fall under this category.

(d) Capital Gains. Profit/loss on account of capital assets fall under this head. Capital assets would include land, house property, gold, financial instruments like shares, mutual fund units etc.

(e) Income from Other Sources. Income which does not fall under any of the above categories would come under this category.

What is Income Tax ?

As the name suggests, it is tax on income. While that is simple to understand, the confusion with most people lies in correctly identifying their sources of income. Not every cash flow would qualify as income, and income from sources other than salary can be negative also. The Income Tax Act distinctly defines the tax rates, applicable deductions, exemptions, allowances or grants under the different heads. Some of the common elements are as under:-

Tax on Income from Salary

Income from salary is taxable as per the income tax slabs. We can compute the total income after factoring the applicable and permissible deductions/exemptions. The different tax slabs give out the applicable tax rates for various income levels.

Tax on Income from House Property

Rent received from house property is taxable at marginal ie applicable rates to the owner. The rent for this purpose is the higher of either the Expected Rent (as per municipal authorities), or the actual rent received. 30% deduction on account of expenses is permissible. You can now show up to two houses as self- occupied. This means that if you have not rented them out, then there is no tax liability on them.

Earlier, tax on only one house was exempted. The second house even if not occupied was deemed to be rented, and the tax liability had to be paid on the Expected Rent. We can adjust the rent against the interest payment on housing loan to the extent of Rs 2 lakh in a yr. Interest paid in surplus of two lakhs can be carried forward as loss from house property for 8 years. This can be adjusted against income from house property in any of the following 8 years.

Taxation of Capital Gains

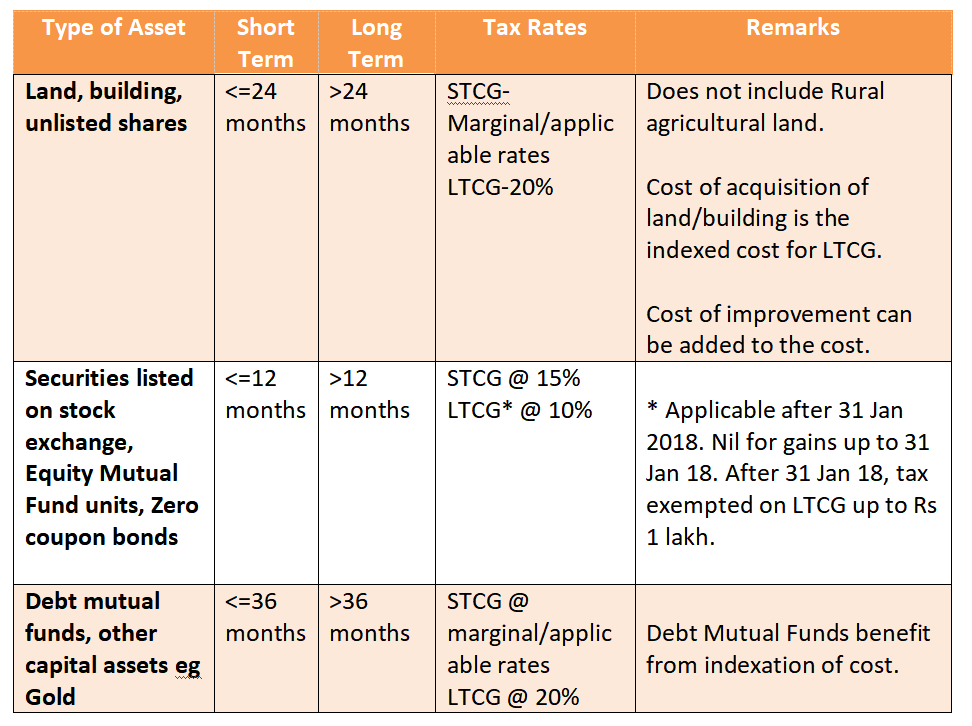

This comprises of gains/losses on account of sale of capital assets. We can broadly divide the capital gains/losses into Long Term (LTCG), and Short term (STCG). This is based on the duration for which the capital asset was held. The tax rates for LTCG/STCG vary for different assets along with some asset specific provisions.

Tax on Income from Business/Profession

Apart from normal business and profession, the speculative gains/losses from day trading in shares/commodities would also fall under this head. You pay tax on gains at marginal, ie applicable rates and can carry forward losses for 8 yrs.

Tax on Income from Other Sources

Dividends, casual income, gifts in excess of Rs 50,000/- and gambling are some of the sources considered here. Any source not fitting in the other categories shall also fall under this category. The tax applicable is at the marginal tax rate.

What is Income Tax Planning ?

In simple terms, it is the planning related to avail all possible tax breaks through legitimate means. As far as salary income is concerned, there are ever decreasing options available. However, after carefully going through all rows in the IT return form, one can identify the possible avenues which can be utilized. With reduced limits, one needs to increase variety and make use of all options rather than overdoing one option.

For eg the aggregate limit under 80C is 1.5 Lk which is less than the mandatory group insurance subscription and Provident Fund deductions. So, for someone who is already compulsorily subscribing more than 1.5 lakh under 80C, there is no incremental benefit in subscribing to additional options like ELSS etc. Whereas NPS gives benefit of additional tax deduction along with returns matching equity funds- however few people subscribe to it. You can read more about NPS in “NPS-Additional Tax Savings with Customizable Returns”

In a nutshell, tax planning relates to structuring the cash inflows and cash outflows in a manner that maximizes the deductions, exemptions, allowances and rebates permissible under laws, thereby minimizing the overall income tax outgo. Structuring cash inflows from salary might not be possible for government employees, but is very common in the private sector. You can time and calibrate to some extent the cash inflows from other sources viz capital gains, business income and income from other sources. One can calibrate his cash inflows from different sources under different heads. This is more applicable for capital gains to keep the tax liability at lowest possible levels.

Income Tax Avoidance.

One should also be aware that while tax planning is perfectly legitimate, laws do not permit tax avoidance, which means willfully not disclosing/deflating income, or inflating expenses so as to avoid/reduce tax. Doing so can invite penalties along with legal action. Very often we might not disclose some income due to sheer ignorance. Tax authorities were so far not detecting this easily due to poor tax monitoring infrastructure. However, with increased tax surveillance and high-tech automated systems backed by Artificial Intelligence, such omissions will become increasingly difficult. Some of the common omissions are, not reflecting interest income from savings account and income earned by spouse from your money. As per tax laws you have to club these incomes for taxation with the income of the provider of funds .

What is Tax Efficiency ?

This relates to choosing the right savings/investment option which maximizes post tax returns. In a way, while tax planning aims at MINIMISING tax outgo, tax efficiency relates to MAXIMISING post tax returns. With increasing incomes, the investible surplus also increases, and we all park/deploy it in some meaningful financial instrument. Most of us utilize the PF which is by far the most efficient risk-free option. However, when we compare options, we should evaluate the Post – Tax returns. In the case of Provident Funds the tax rate on return is zero; therefore, post tax return is 7.1%.

In the case of an FD giving 6.5% return , there will be tax at the rate of 30%. This reduces the effective returns to 4.5%. Now if we have a Debt fund which is kept for more than 3 yrs- the gains thereafter fall under Long Term Capital Gains (LTCG). The tax rate on these gains will be 20% after indexation.

So, even if the annualized returns from Debt funds are equal to FD i.e. 6.5% (though in all probability it would be more), the annualized post-tax returns after holding for three years will be 5.2%. This is about 1.3% more than the returns from FD. Add to it the benefit of indexations and the tax liability reduces further, increasing the returns. Similarly, an Equity Fund / stock giving 13 % annualized returns in a year will be taxed at 10%, making the post-tax returns to 11.7%. Long Term Capital Gains up to 1 Lakh from equity are also exempted from tax.

Conclusion

The main purpose of discussing both Tax planning and Tax Efficiency is to highlight the point that, it is not the amount of tax saving that is important alone. The post-tax returns are more important, and should be considered while evaluating various savings/investment options. The aspect of Tax planning needs to be considered in conjunction with Tax Efficiency.