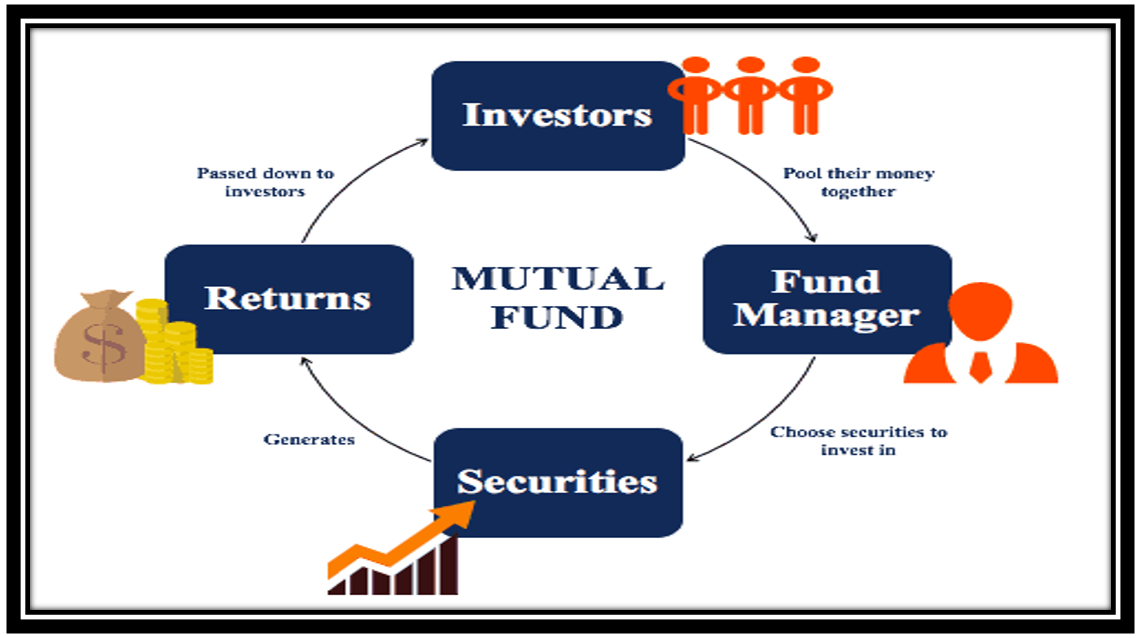

All readers would be very familiar with the term Mutual Funds, and most of us have also invested our savings in various Mutual Fund Schemes. During interaction with many of my friends I got a feeling that most of them had a very vague understanding of how Mutual Funds work. Understanding Mutual Funds is important […]