In another discussion we have talked about issues related to Risk and the characteristics of various assets classes. When we talk of risk bearing investments, it means that there is scope of erosion in the invested capital. And this is what dissuades most of us from investing in such asset classes. The irony however is that, in the long run, the risk-free instruments are more-risky as compared to risk bearing ones. Nevertheless, the challenge in this context is how to minimize risk. One of the fundamental methods of minimizing risk is through Asset Diversification.

Need for Asset Diversification

There are several reasons to diversify. To comprehend the importance, we will have to understand the function of correlation. Take a simple example of two businesses, one dealing in import, and another in exports. Any change in forex rate fluctuation will affect both the businesses. But the effect will be in opposing directions. While one will benefit, the other shall lose. But if I am holding shares of both these firms, then my gains and losses shall cancel out. This is a case of inverse relationship, or negative correlation. Similarly, there could be a positive correlation, or no correlation at all. Different asset classes have different patterns and cycles of growth and decline. The cycles may be long or short depending on the nature of asset class. It is very rare that all asset classes move in the same direction with same speed at any given time.

We saw during COVID times that equity markets were down and Gold was surging ahead. The real estate market had a bull run, but faced tough times since demonetization. The debt market seems to be giving better returns when equity is falling. This leads us to the fact that if we hold some part of all types of asset classes, then we are shielded against the risk to one particular asset/sub-asset class at any given time. The same context applies to all sub asset classes within each asset class. Asset Diversification helps us construct a portfolio which provides us the desired overall portfolio return, while balancing risk.

Asset & Sub-asset Classes

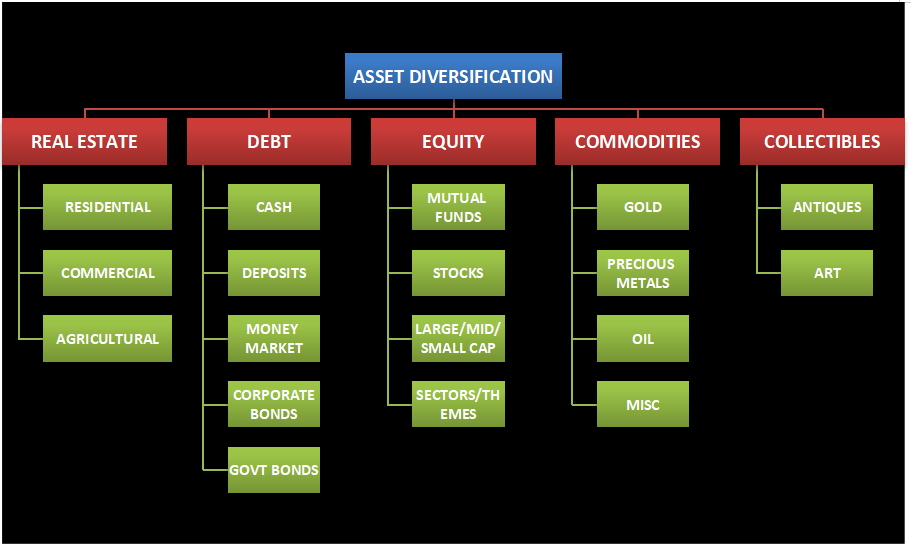

The diagram given below should provide a fair idea of various asset classes and the different sub-asset classes within each asset class. The list is only indicative and not exhaustive.

How to Diversify

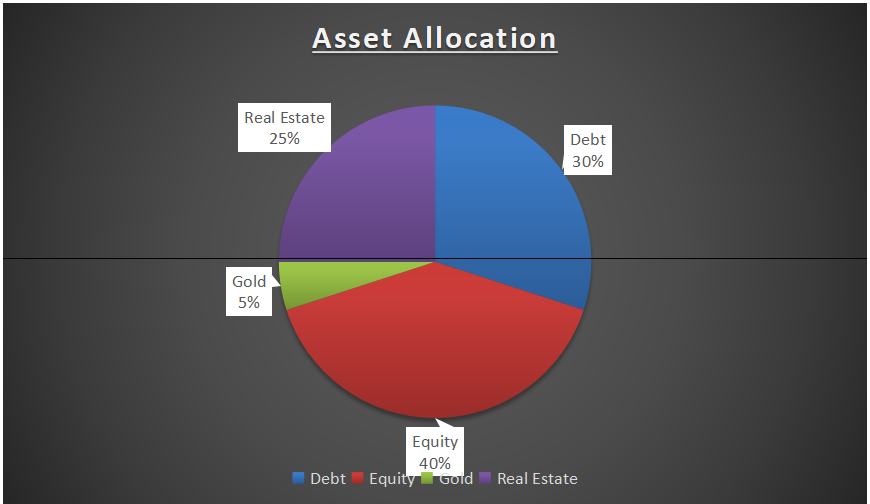

The process of Asset Diversification is not difficult, but often omitted. Investing without a pre-defined Asset allocation is akin to constructing a house without deciding on the number of rooms and their sizes. A proper blueprint would involve going into further details. You have to decide on the percentage of your investible net worth which will be deployed under various asset classes. It is not necessary to select all classes as not everything would be appealing to everyone. For example, one Asset Mix could be as under:-

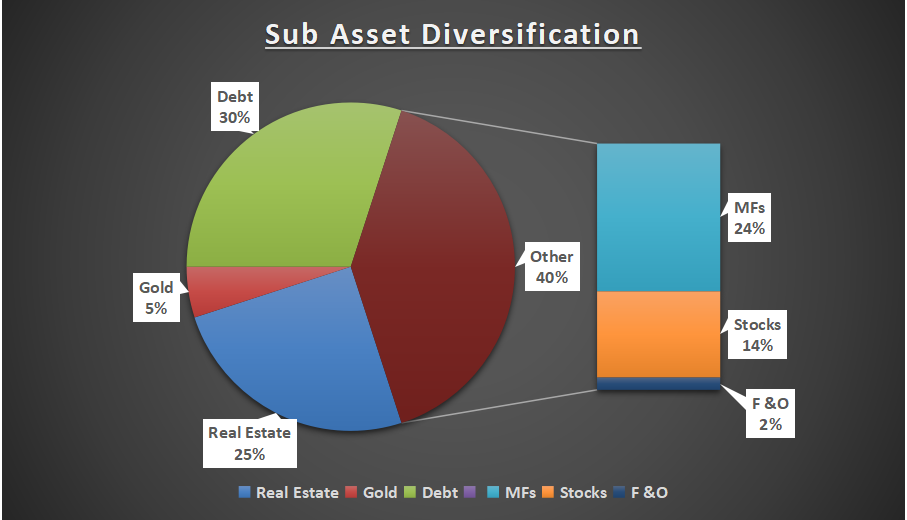

Further one can sub-allocate the relevant portion of a particular asset class to concerned sub asset classes as under:-

Multi Layered Diversification

The asset diversification does not end here and continues to subsequent levels as well. For eg in case of Mutual Funds, one would need to divide the share between Large Cap, Mid Cap, Small Cap and Sectoral/Thematic funds. In the case of shares, one would have to pick up stocks from at least ten different, preferably unrelated sectors. One can also follow the 5 % rule. Wherein the weightage of one company in the entire stock portfolio should not be more than 5%, making it a minimum of 20 stocks.

How much to Diversify ?

Diversification minimizes systematic risk to a great extent, but beyond a point it is not going to give added benefits. One should therefore guard against over-diversification wherein the management of the portfolio becomes difficult. Once the diversification has been implemented, we need to monitor the performance regularly and carry out the rebalancing and readjustment. After about a year, we might find some winners, and some losers in the portfolio. And their market value would have altered the asset allocation. We can first review the overall Asset allocation again. This should generally be changed only on account of strong reasons and convictions. The instruments should thereafter be redistributed to fit the changed/unchanged asset allocation. For eg if the Equity portfolio has fared well and now comprises 45% of the portfolio against the decided 40%, and the debt part has fallen down, then we should shift 5% from Equity to Debt.

Conclusion

Doing the same exercise for all levels appears to be a tedious process. But we don’t have to do it very frequently, and it is very much worth the effort. Every asset class has a particular time frame in which its performance indicators can reliably tell us whether or not it is worth holding further. At this point, one should not hesitate to shed the assets which are not performing up to the relative benchmarks. We should strive to achieve the desired overall returns from the entire portfolio.