The eagerly awaited Budget 2021 has been presented in the Parliament and is likely to be passed soon. The most important element which we all watch out for in the budget are the Direct Tax implications. Budget 2021 had added interest because of the severe COVID impact which the Global and country’s economy continues to face. It is also a recurring expectation that the budget shall further reduce the tax burden, and progressively the same has been happening also. However due to the COVID overhang it would have been difficult for the Govt to satisfy all tax payers. Proper tax-planning is important to minimize tax burden and therefore we need to understand the tax implications of Budget 2021.

Underlying Philosophy

The speech of the Finance Minister and statements given to media indicate that they took a conscious decision not to fund the proposed additional government expenditure through taxation. So, Tax Payers can take solace that despite compelling circumstances, the tax slabs have been kept unchanged. Budget 2021 gives more focus to improving the Tax compliance infrastructure. Two of these proposals which might have direct implications in filing of IT Returns for some salaried class tax payers are as under: –

Exemption to Senior Citizens.

Senior Citizens with income only from pension and interest are now exempt from filing of tax return. Banks will deduct tax at source. But it is not likely to benefit many people, as it was not mandatory for those with lesser pension and interest to file IT Returns. And those with higher pensions will be having income from other sources also.

Auto Filling of Data.

Though the proposal aims at adding convenience to tax fillers, the aspect of auto filling of data regarding equity transactions might be of concern to the casual investors who conveniently forget to include these in the Tax-Returns. The new system will make it necessary to factor gains from such transactions in the IT-Returns. For the conscious investors it will simplify the process of entering such data in their IT returns.

Tax Implication on Interest Earned on Provident Fund Subscriptions.

One of the best avenues for Tax-Free and Risk-Free returns is Provident Fund. Based on the principles of Equity (taxation as per ability to pay), the budget has proposed that interest earned on any subscription above ₹ 2.5 lakh in the year (starting 01 Apr 21) will be taxed (₹ 5 lakh in case employer does not contribute). As no separate tax rate has been specified, it can be assumed that it will be treated as interest income and taxed at the marginal/applicable rate of tax. This has generated lot of anxiety amongst those who make heavy subscriptions to their PF accounts. Let us first understand how this new provision is likely to be applied.

Case A.

If your total subscription to PF in the year is less than ₹ 2.5 lakh, then there is no additional tax burden. This new proposal will have no effect on such cases. The monthly subscription in this case will be less than ₹ 20,833/- per month.

Case B.

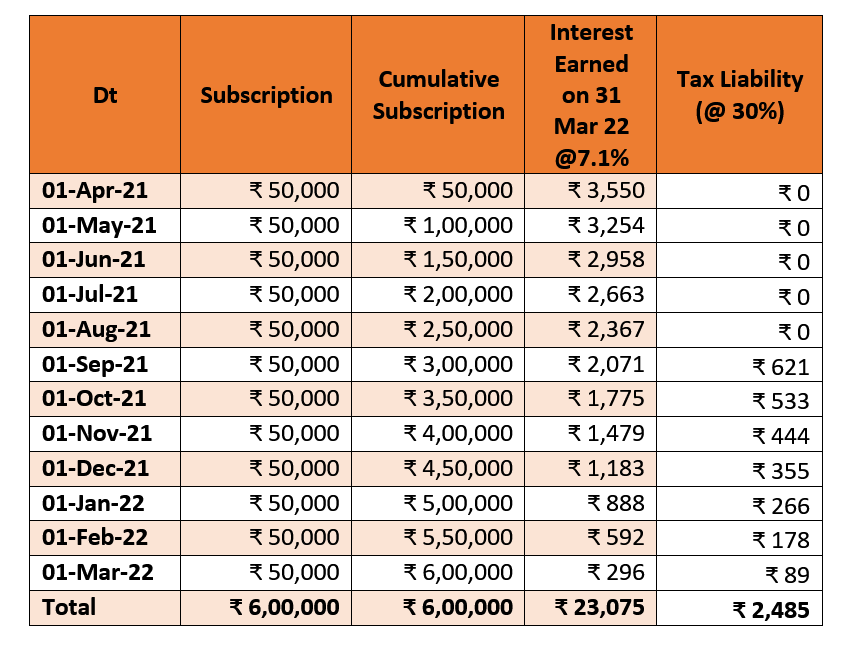

If your monthly subscription is more than ₹ 20833/-, say, ₹ 50,000. then the total subscription in the year will be ₹ 6 lakh. This is ₹ 3.5 lakhs more than the proposed ceiling. The tax-free subscription amount will be subscribed in the first 5 months. The interest earned on this at the end of the year will be tax-free. The interest earned on the balance subscription ie for the amount subscribed in the next 7 months will be taxed at marginal rate.

In this case at prevailing rates (7.1% for GPF) the interest credited at the end of the Financial Year will be approximately ₹ 23,075/-. Out of this about ₹ 14,792/- will be attributed to the first ₹ 2.5 lakh and therefore will be tax-free. The balance ₹ 8,283/- will be taxed at applicable rates. If the highest applicable tax rate is 30%, the tax liability will be approximately ₹ 2,485/-. The table below will make it more clear.

Tax on Interest Accrued on Accumulated Corpus. The proposal does not affect the accumulated corpus. Any interest earned on the corpus accumulated in preceding years would be tax-free. This proposal will be applicable only for subscriptions after 01 Apr 21.

What Are Your Options ?

Reduce Subscription.

In case you want to incur zero tax liability, then you must keep the monthly subscription to PF below ₹ 20, 833/- (₹ 41,666/- if employer does not contribute). You will have to explore other options to deploy the balance money after doing the risk-return analysis.

Continue with Increased Subscription.

In case you are not comfortable with any change in your investment/savings options, then you may just accept the additional tax-burden and continue as hitherto. However, those who have still many years to retire, must calculate the overall long-term impact and take a conscious decision. Those who are retiring soon will in any case have to seek other options.

Preserve Accumulated Corpus.

In the revised context, it is important to exercise caution while making any withdrawals from accumulated corpus. The interest on this corpus is Tax-free, and if withdrawn, the tax-free returns will also reduce. The ploughing back if planned at later stage will have to be under the new provisions with tax implications.

What are the Other Options to Mitigate Tax Implications?

We need to realise that the instrument of Provident fund is available only till we retire. Except for PPF which we can continue after retirement also with limited subscription. It is therefore prudent to become familiar with other investment options well in time and diversify the portfolio. Two basic criteria to evaluate other options are security of capital (Risk) and Returns. It will be difficult to find any other comparable option with the same kind of risk-free returns.

It however needs to be noted that meaningful Real returns factoring inflation will be possible only at some risk. And in the evolving scenario, not taking any risk is the riskiest option. If one does not want to invest in equity, then Debt Mutual Funds remain the only comparable option. Those who are looking for complete safety can invest in Gilt Funds. Funds investing in AAA rated Corporate Bonds can be considered in some proportion. Credit risk funds which have the potential to give higher returns, are not recommended as they carry more risk.

Recommendations

- Limit the annual subscription to PF up to non- taxable ceiling of ₹ 2.5 lakh/₹ 5 lakh as applicable.

- Invest the balance of investible surplus in safe Debt Mutual Funds or Equity Mutual Funds/ETFs.

- Factor income from all sources while filing your IT-Returns.

3 replies on “Budget 2021- Direct Tax Implications”

An apt summation of Direct taxes and its implications with specific elucidation on one’s should be contribution towards EPF. Thanks for keeping the environ updated on Budget 2021 has to offer 4 salaried class.

Thanks for the informative article. The implications of GPF subscription have been explained in a simplified manner. The other modes of saving / investment should also be explored by the tax-payers.

I feel PF is still a safe option for those who are not well acquainted with capital market. Article gives clarity for those who can do otherwise….